Fintech

Leverage structured and unstructured data to improve the predictive power of models

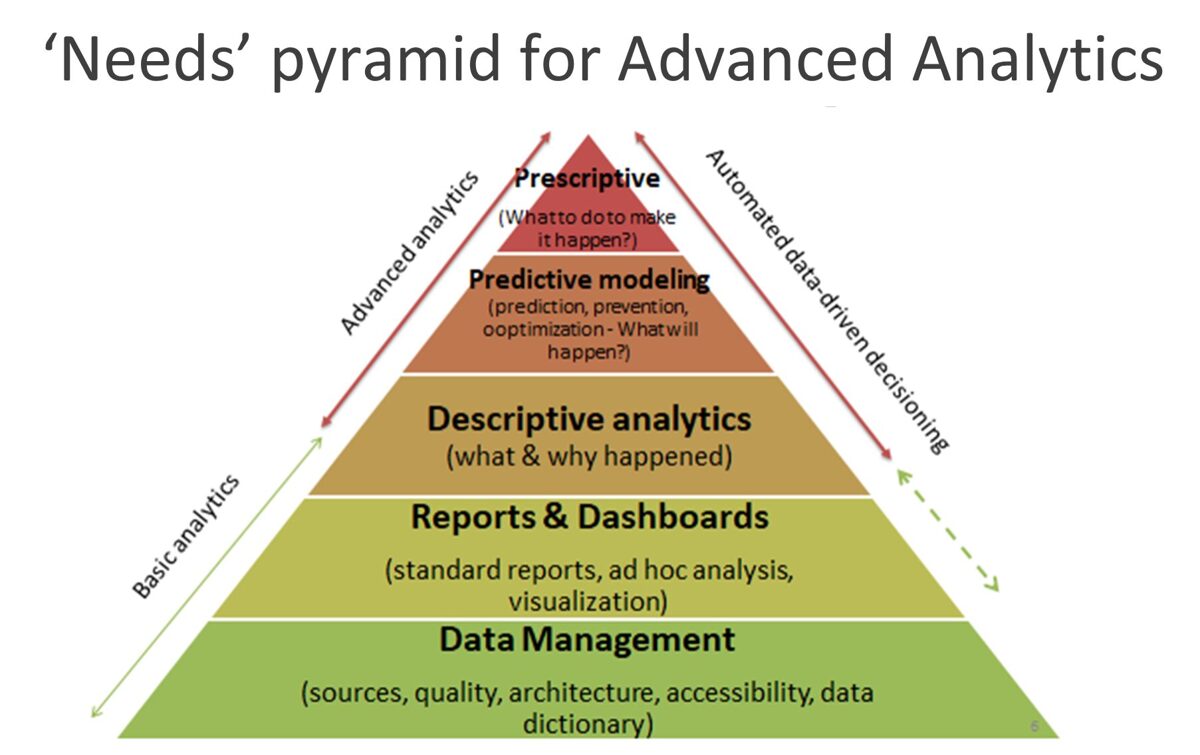

Data Science

Use of statistics, machine learning, predictive modeling, and other analytical techniques to uncover insights about customers, products, and other areas of research

Provisioning

Creating automated reports based on IFRS for internal or external (investor, auditor, regulator) requirements

Risk Management

Full scope risk management - from customer analysis to segmenting defaults, to tool usage for processes, and strategy for customer engagement